Contents

- 1 EPF vs EPS Difference: Your Ultimate 2025 Guide to Unlocking Your Retirement Benefits

- 2 Deep Dive into EPF: Your Personal Retirement Savings Account

- 3 Deep Dive into EPS: Your Lifelong Pension Promise

- 4 EPF vs EPS Difference: A Head-to-Head Showdown

- 5 Clearing the Air: Common Myths and Misconceptions

- 6 Working Together: How EPF and EPS Complement Each Other

- 7 Why Does Understanding the EPF vs EPS Difference Matter So Much?

- 8 Conclusion: Two Pillars for Your Secure Future

- 9 Frequently Asked Questions (FAQ)

- 9.0.1 1. What is the main EPF vs EPS difference in simple terms?

- 9.0.2 2. Does my 12% PF contribution go into both EPF and EPS?

- 9.0.3 3. Can I withdraw my EPS money for emergencies like I can with EPF?

- 9.0.4 4. How much pension will I get from EPS? Is it enough to live on?

- 9.0.5 5. What happens to my EPS if I change jobs frequently?

- 9.0.6 6. Is the EPS pension I receive after retirement taxable?

- 9.0.7 7. What is the Scheme Certificate in EPS?

EPF vs EPS Difference: Your Ultimate 2025 Guide to Unlocking Your Retirement Benefits

Your payslip arrives every month, and amidst the familiar deductions, two acronyms often appear, seemingly intertwined yet distinctly separate: EPF and EPS. You know they relate to your retirement, managed by the Employees’ Provident Fund Organisation (EPFO), but let’s be honest – the lines often blur. What exactly *is* the EPF vs EPS difference? Is one a savings pot and the other a pension plan? How much goes into each? Can you withdraw from both? And most importantly, what do they actually mean for your financial security after you hang up your work boots?

This confusion isn’t just common; it’s almost universal among India’s salaried workforce. Untangling these two crucial components of your social security is absolutely essential for effective financial planning. Mistaking one for the other or misunderstanding the rules can lead to unpleasant surprises down the road. This ultimate guide is designed to be your definitive resource, your friendly navigator through the often-confusing world of EPFO schemes. We will meticulously break down the EPF vs EPS difference, exploring exactly what each scheme is, how your money gets allocated, the specific benefits they provide, the vastly different withdrawal rules, and how they work together to form the bedrock of your retirement security. Let’s finally clear the fog and empower you with the knowledge you need.

Deep Dive into EPF: Your Personal Retirement Savings Account

Let’s start with the one most people are more familiar with: the Employees’ Provident Fund (EPF). Think of this as your personal, long-term savings account specifically designed for retirement, but with some powerful added benefits. The employee provident fund explained simply is a forced savings mechanism.

The Core Concept: Building Your Nest Egg

The fundamental idea behind EPF is to help you build a substantial corpus over your working life. It operates on a contribution model:

- Your Contribution: Every month, a fixed percentage (currently 12%) of your basic salary plus dearness allowance is deducted from your pay and deposited into your EPF account.

- Your Employer’s Contribution: Your employer matches your contribution, also putting in 12% of your basic + DA.

So, effectively, a total of 24% of your basic salary + DA is funnelled towards your retirement savings structure each month. However, it’s not quite that simple, because this is where the EPS comes into play (we’ll get to that in a moment).

Where Does the Employer’s 12% Really Go? (The EPF/EPS Split)

Here’s the crucial split you need to understand: While you contribute your full 12% directly to your EPF account, your employer’s 12% contribution is divided:

- 8.33% goes towards the Employees’ Pension Scheme (EPS), subject to a wage ceiling (currently ₹15,000 per month). So, the maximum EPS contribution per month is ₹1,250 (8.33% of ₹15,000).

- The remaining balance (12% minus the 8.33% diverted to EPS, or 3.67%) goes into your EPF account. If your basic+DA exceeds ₹15,000, the entire employer contribution above ₹1,250 also goes into your EPF.

So, your EPF account accumulates your 12% contribution PLUS the portion of your employer’s contribution that doesn’t go to EPS. This combined amount then earns a government-declared interest rate each year, compounding powerfully over time. This structure is central to the EPF vs EPS difference.

The Power of Compounding and Tax Benefits

The EPF is incredibly attractive due to two main factors:

- Compound Interest: The interest earned each year is added to your principal, and future interest is calculated on this larger amount. Over a 30-40 year career, this compounding effect leads to exponential growth of your savings.

- EEE Tax Status: EPF enjoys an Exempt-Exempt-Exempt tax status. This means your contributions are tax-deductible (under Section 80C up to ₹1.5 lakh limit), the interest earned is tax-free, and the final withdrawal amount upon retirement is also tax-free (subject to certain conditions like 5 years of continuous service). This makes it one of the most tax-efficient savings instruments available.

Accessing Your EPF Funds: Withdrawals

While primarily a retirement fund, the EPF scheme allows for partial, non-refundable withdrawals (advances) under specific circumstances before retirement. These rules have been significantly eased recently, a topic we explored in our guide on the EPFO new rule change. Common reasons include:

- Medical emergencies for self or family.

- Purchase or construction of a house, or repayment of a home loan.

- Marriage expenses for self, children, or siblings.

- Children’s higher education expenses.

- Unemployment (with specific conditions and timelines).

The full EPF balance can typically only be withdrawn upon retirement (after age 58), or under specific conditions like prolonged unemployment or permanent migration abroad. Understanding the epf withdrawal rules vs eps withdrawal is key, as EPS operates very differently.

In essence, the employee provident fund explained simply is your personal retirement savings pot, fuelled by your contributions and a part of your employer’s, growing tax-free with compound interest, and accessible under specific conditions before retirement.

Deep Dive into EPS: Your Lifelong Pension Promise

Now, let’s turn our attention to the Employees’ Pension Scheme (EPS), established in 1995. This is where the other part of your employer’s contribution (the 8.33%, capped at ₹1,250/month) goes. Unlike EPF, EPS is not a savings account where your individual contributions grow. Instead, it’s a pooled fund designed to provide a defined benefit – a monthly pension – after you retire.

The Core Concept: Assured Monthly Income After Retirement

The fundamental goal of EPS is to provide a safety net, an assured minimum income stream for employees in their old age. Think of it less like a personal bank account and more like a social security scheme funded by contributions made during your working life.

Who Contributes? Only the Employer (and Government)

This is a major point in the EPF vs EPS difference: You, the employee, make NO direct contribution to the EPS fund. Only the employer’s 8.33% (up to the wage ceiling) is diverted here. Additionally, the Central Government contributes a small percentage (currently 1.16%) of the employee’s salary towards the scheme for eligible members.

Eligibility for Pension: The 10-Year Hurdle

To receive a monthly pension under EPS after retirement (age 58), you must meet a crucial condition: you need to have completed at least 10 years of ‘eligible service’. This doesn’t necessarily mean 10 continuous years with one employer. If you switch jobs between EPF-covered establishments and transfer your PF account correctly, your service periods are added together. Falling short of this 10-year mark has significant consequences, as we’ll discuss under withdrawals.

Calculating Your Pension: The Formula Explained

The monthly pension amount under EPS is not directly linked to the total amount contributed in your name. Instead, it’s calculated using a defined formula:

Monthly Pension = (Pensionable Salary x Pensionable Service) / 70

- Pensionable Salary: This is typically the average monthly salary (Basic + DA) drawn during the last 60 months (5 years) before retirement, subject to the statutory wage ceiling (currently ₹15,000 per month unless you opted for higher contribution).

- Pensionable Service: This is the total number of years you have contributed to the EPS scheme, rounded to the nearest year (maximum typically capped at 35 years for the formula, though service beyond that might earn bonuses).

Example Pension Calculation:

Suppose an employee retires at 58 after contributing to EPS for 30 years. Their average salary in the last 5 years was consistently above the ₹15,000 ceiling.

- Pensionable Salary = ₹15,000 (the ceiling applies)

- Pensionable Service = 30 years

- Monthly Pension = (₹15,000 x 30) / 70 ≈ ₹6,428 per month

This calculated amount is the pension the individual will receive for life. There are also provisions for reduced pension if one opts for early retirement (between 50 and 58) and provisions for spousal/nominee pensions upon the pensioner’s death. Understanding the difference between epf and eps calculation is vital.

Accessing EPS Funds: Withdrawals (It’s Different!)

This is where the epf withdrawal rules vs eps withdrawal starkly contrast. You generally CANNOT make partial withdrawals from the EPS fund for emergencies like you can with EPF.

- Before 10 Years of Service: If you leave employment before completing 10 years of eligible service, you cannot get a monthly pension. Instead, you are eligible to withdraw the accumulated EPS amount as a lump sum using Form 10C. The amount you get back is based on a table related to your salary and service period, not necessarily the exact sum of contributions.

- After 10 Years of Service: If you leave employment after completing 10 years but before reaching retirement age (58), you cannot withdraw the EPS amount. You are instead issued a ‘Scheme Certificate’. This certificate locks in your pensionable service. When you reach retirement age (even if you were unemployed or self-employed in the interim), you can submit this certificate to claim your monthly pension based on the service period mentioned.

- Upon Retirement (Age 58+): If you have 10+ years of service, you apply for your monthly pension using Form 10D.

So, EPS money is primarily locked in for providing a pension, unlike the more accessible EPF corpus. Fully grasping the employees pension scheme eligibility and withdrawal rules is key.

In essence, EPS is your employer-funded (plus government contribution) pension promise, providing a defined monthly income after retirement, contingent on completing at least 10 years of service.

EPF vs EPS Difference: A Head-to-Head Showdown

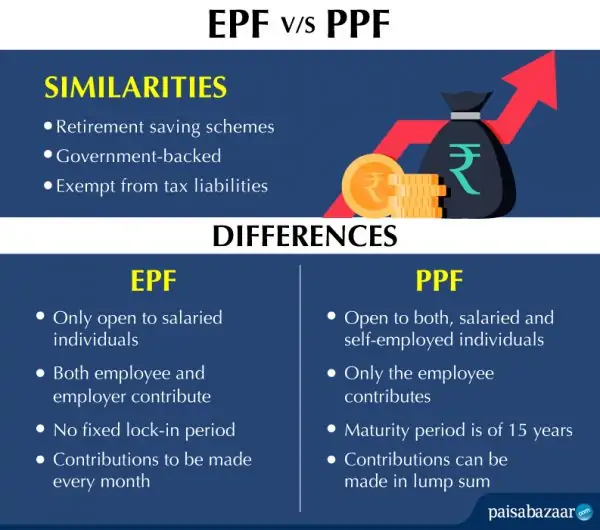

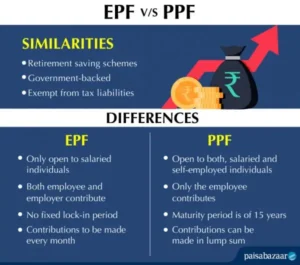

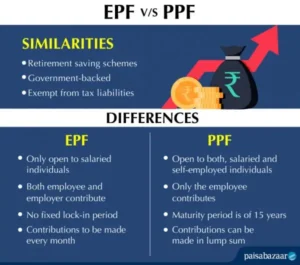

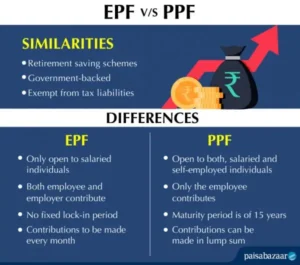

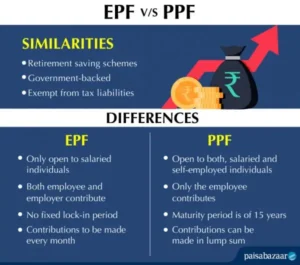

Let’s consolidate the key differences in a clear, comparative format to solidify your understanding:

| Feature | Employees’ Provident Fund (EPF) | Employees’ Pension Scheme (EPS) |

| :——————– | :————————————————— | :—————————————————— |

| **Primary Goal** | Retirement Savings Corpus (Lump Sum) | Monthly Pension After Retirement |

| **Contribution By** | Employee (12%) + Employer (Part, e.g., 3.67%+) | Employer Only (8.33% up to ₹1250/month) + Govt (1.16%) |

| **Benefit Type** | Defined Contribution (Lump sum = Contributions + Interest) | Defined Benefit (Pension based on Formula) |

| **Withdrawal Rules** | Partial withdrawals allowed for specific needs. Full withdrawal on retirement/specific cases. | Generally, no partial withdrawal. Lump sum if <10 yrs service, Pension if 10+ yrs service. | | **Eligibility for Benefit** | Available upon withdrawal/retirement. | Minimum 10 years eligible service required for pension. | | **Taxation** | EEE (Exempt-Exempt-Exempt) – Generally Tax-Free | Pension received is taxable as per income slab. | | **Form for Claim** | Form 19 (Final), Form 31 (Advance) | Form 10D (Pension), Form 10C (Withdrawal Benefit) |

Understanding this table is the core of grasping the EPF vs EPS difference.

Clearing the Air: Common Myths and Misconceptions

Given the complexity, several myths often circulate about EPF and EPS. Let’s bust a few:

- Myth: “My entire 12% employer contribution goes into my EPF.”

- Fact: No, a significant chunk (8.33% up to ₹1250/month) is diverted to EPS for your pension.

- Myth: “If I withdraw my EPF early, I lose my pension.”

- Fact: Not necessarily. If you have less than 10 years of service, you withdraw both EPF and the EPS withdrawal benefit. If you have more than 10 years, you withdraw only your EPF; your pension rights remain intact via the Scheme Certificate until you reach retirement age.

- Myth: “The EPS pension amount depends on how much total contribution went into EPS.”

- Fact: No, the pension is solely based on the formula involving your pensionable salary and service period, not the actual accumulated contributions.

- Myth: “EPS pension is tax-free just like EPF withdrawal.”

- Fact: False. The monthly pension received under EPS is treated as income and is taxable according to your income tax slab in retirement.

Being aware of these facts helps in making informed decisions about your epfo retirement benefits comparison.

Working Together: How EPF and EPS Complement Each Other

It’s crucial to see EPF and EPS not as rivals, but as two complementary pillars supporting your retirement. They are designed to work in tandem:

- EPF provides the substantial lump-sum corpus needed for major post-retirement goals: perhaps buying a smaller home, funding children’s weddings, creating a medical emergency fund, or even starting a small post-retirement venture.

- EPS provides the regular, predictable monthly income stream needed to cover basic living expenses throughout your retired life, offering a crucial safety net against outliving your savings.

A well-funded EPF account combined with a guaranteed EPS pension offers a much more robust and balanced retirement security than either could provide alone. This synergy is the intended outcome of the overall EPFO framework, which also includes the often-forgotten life insurance aspect covered by the EDLI scheme benefits.

Why Does Understanding the EPF vs EPS Difference Matter So Much?

This isn’t just academic knowledge. A clear understanding empowers you to:

- Plan Your Retirement Realistically: Knowing the likely pension amount from EPS helps you calculate how much additional corpus you need from EPF and other investments to achieve your desired retirement lifestyle.

- Make Informed Withdrawal Decisions: Understanding that EPS funds are largely inaccessible before retirement reinforces the need to protect your EPF corpus for genuine long-term needs.

- Ensure Correct Account Transfers: When changing jobs, ensuring your service period transfers correctly is vital for meeting the 10-year EPS eligibility hurdle.

- Optimize Tax Planning: Knowing which component is taxable (EPS pension) and which is tax-free (EPF withdrawal) helps in post-retirement tax planning.

Knowledge about the EPF vs EPS difference translates directly into better financial preparedness.

Conclusion: Two Pillars for Your Secure Future

Navigating the world of retirement benefits can feel like deciphering a complex code, but understanding the fundamental EPF vs EPS difference is the master key. They are two distinct yet complementary schemes, orchestrated by the EPFO to provide a dual safety net for your post-employment life. EPF is your personal savings powerhouse, growing through contributions and compounding interest to give you a substantial lump sum. EPS is your collective pension promise, ensuring a steady monthly income stream based on your years of service.

By grasping how each scheme works, how they are funded, and the rules governing access to their benefits, you empower yourself to make smarter financial decisions throughout your career. Don’t let these acronyms remain a mystery on your payslip. Take the time to understand them, ensure your nominations are in place, and plan diligently. Your future, retired self will thank you profoundly. For the most authoritative and detailed rules, always refer to the official EPFO website.

Frequently Asked Questions (FAQ)

1. What is the main EPF vs EPS difference in simple terms?

Think of EPF (Employee Provident Fund) as your personal savings account for retirement that grows with interest, giving you a lump sum at the end. Think of EPS (Employees’ Pension Scheme) as a separate scheme, funded mainly by your employer, that promises to pay you a fixed monthly pension after you retire (if you meet the 10-year service criteria).

2. Does my 12% PF contribution go into both EPF and EPS?

No. Your 12% contribution goes entirely into your EPF account. It’s your employer’s 12% contribution that gets split: 8.33% (up to ₹1250/month) goes to EPS, and the rest goes into your EPF account.

3. Can I withdraw my EPS money for emergencies like I can with EPF?

Generally, no. EPS funds cannot be withdrawn partially for emergencies. If you have less than 10 years of service when you leave a job, you can withdraw the EPS amount as a lump sum (Withdrawal Benefit). If you have 10 years or more, the money stays locked in until retirement to provide a monthly pension.

4. How much pension will I get from EPS? Is it enough to live on?

The pension is calculated based on a formula: (Pensionable Salary x Pensionable Service) / 70. Since the pensionable salary is capped (currently ₹15,000/month), the maximum basic pension is often modest (around ₹7,500 for 35 years of service, though bonuses can increase it). It provides a basic safety net but is generally not sufficient to cover all retirement expenses on its own. Understanding the difference between epf and eps calculation is key to planning.

5. What happens to my EPS if I change jobs frequently?

It’s crucial to transfer your EPF account (which automatically transfers the linked EPS service history) each time you change jobs using your UAN. As long as you complete a total of 10 years of eligible service across different employers before retirement, you will be eligible for the monthly pension. If your total service remains below 10 years, you can only withdraw the EPS amount.

6. Is the EPS pension I receive after retirement taxable?

Yes. Unlike the EPF lump sum withdrawal (which is generally tax-free after 5 years of service), the monthly pension received under the Employees Pension Scheme eligibility rules is treated as income and is taxable according to the income tax slab applicable to you during retirement.

7. What is the Scheme Certificate in EPS?

If you leave a job after completing 10 years of EPS service but before reaching retirement age (50/58), you are issued a Scheme Certificate by the EPFO. This certificate officially records your pensionable service period. You need to keep this safe and submit it when you eventually apply for your monthly pension after reaching the eligible age.